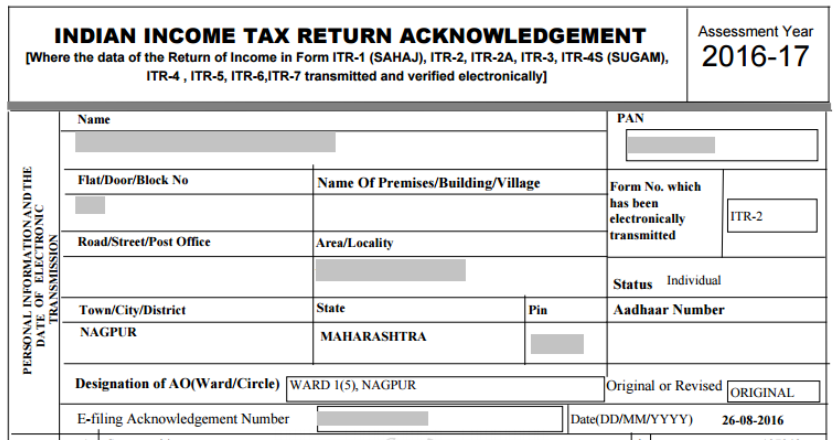

ITR 4- Individuals/HUFs income having income from proprietorship business or profession ITR 3- Individuals/HUFs being firm’s partners and running business or profession under proprietorship

ITR 2A- Individuals & HUFs having income other than income from business or profession and capital gains and holds no foreign assets. ITR 2- Individuals & HUFs having income other than income from Business or Profession ITR 1 (SAHAJ) - Individuals having Salary and Interest Income These are forms for various categories of people showing the tax liability. Section 206C (1A) of Income Tax Act, 1961 states that a declaration must be made by a buyer for taking goods without tax collection.

This form is an annual statement indicating all the tax related information (TDS, TCS, refunds, etc.) connected with the PAN Card of a person. Under section 203 of the Income Tax Act, 1961 the tax deducted at source (TDS) other than from salary income, i.e., non-salary incomes are reflected in this certificate. Under section 203 of the Income Tax Act, 1961 the tax deducted at source (TDS) from the income earned as salaries is reflected in this certificate.

0 kommentar(er)

0 kommentar(er)